E-BILLING AND ITS IMPACT ON LAW FIRM PROFIT MARGIN

Over the course of the past decade, Insurance Carriers, TPAs and large corporations in the US have invested over a billion dollars on bill review vendors and better bill review platforms in order to ensure that each of the panel invoice submitted to them is entirely compliant with their individual billing guidelines.

On the other hand, law firms have not competently risen to the occasion and have retained their use of outdated practice management and billing software that were developed around the late 90’s or early 00’s. None of these tools are capable of matching the optimal standards set by the tools that the bill review vendors are equipped with today.

Much of my conversation with Billing Directors and Managing Partners revolves around the increasingly aggressive nature of bill review vendors across the US.

To gain further insight into why they might be becoming aggressive, we need to consider two things:

The competition is rather strong. Every year over the past decade, the number of bill review vendors across the US alone has been steadily increasing, with new players entering the field with their updated tools and methodologies. Which means that in order to hold on to their existing clients as well as consistently acquire new ones, the bill review tools have to be constantly fine-tuned as well as the staff have to be trained to not miss the slightest non-compliance on invoices submitted to their clients.

Expectations are high, as are the stakes. The US average reduction on law firm invoices is 6% and the increasingly demanding clients expect their preferred bill review vendors to meet this average and improve their overall performance.

Technology is by far the only solution for law firms to tackle various billing guidelines and ensure that they are consistently compliant with those of their clients. Implementing new technology and appropriate changes to the billing department shall impact positively on the law firms’ cash flow and help save them time.

An ill-advised strategy currently in practice to maintain compliance with client guidelines is for law firms to add more resources to the billing team or write-off high amounts off the pre-billed invoices. If you ask me, this is nothing short of a recipe for disaster as it neither addresses the core issues nor provides any strategy towards an effective solution.

Here are some of the issues being faced by law firms today:

- The use of outdated practice management and billing software.

- The software being used does not guarantee them full compliance with their clients’ billing guidelines.

- There is clear frustration between the firm’s timekeepers and the billing department on account of lack of clarifications on the bill entries, especially following reductions made on invoices by bill review vendors for “vague entries” or “lawyers performing paralegal tasks”.

- Constant write-offs on pre-billed invoices.

- Delayed invoice payments resulting from disputes between the billing clerks and the bill review company.

- Poor budget tracking that occurs as a result of law firms not paying any heed to their Budget vs Actual Legal Spend. In many cases law firms spend days or weeks wondering why payment has not yet been received for their invoices that were reviewed and authorized by bill review vendors. And the reason for this delay is the lack of reserves in order to pay the bills. So unless your firm is tracking its budget regularly and prompts TPAs or clients when a new budget is required, they are most likely to not have appropriate reserves in place when your bill is ready for payment.

- Poor law firm performance metrics, resulting from many law firms actually believing that the only metrics required for a firm are the ones present in the invoices and their billing systems. Examples of such overrated metrics include studying which timekeeper bills the most, which clients owe the firm the most amount of money or which customer is generating more billable hours. In practice, all these metrics are just measuring non-events. Meanwhile, many bill review vendors are gathering metrics on law firms and providing this data to laws’ clients, this has actually led some clients to claim “that they know law firms better than the firms’ managing partners do”. Forward thinking law firms should be looking to gather the same metrics as the bill review vendors do or be using a platform through which they can pull these metrics easily. Some of the important metrics that firms should be gathering and presenting to their clients are: firm closing ratio, litigation aging, spend ratio, etc.

If left unaddressed, all the above-mentioned issues will lead to

- Time wasted by timekeepers and billing staff.

- Poor or ineffecient billing practices, along with unnecessary stress placed on the timekeepers as well as the billing departments.

- Constant disputes between your billing department and bill review vendors.

- Increased write-off amounts.

- Delayed payment of invoices.

- Cumulatively, all of these result in constant decrease in law firm profit margin.

In Summary

All law firms, especially insurance defence and worker comps firms should seriously take a look at their current time tracking and billing platform and either upgrade to (if available) or entirely switch to a platform built on the latest technology enabled with advanced tools similar or better than what bill review vendors currently have which allow them to check billing guidelines’ non-compliance on firms’ invoices.

While initially the law firms’ staff might be reluctant to implement such changes, it is up to the firm’s management to help the staff realise the importance of such changes to help increase the firm’s profit margin.

Firms which fail to implement the right technology or move forward as technology evolves, stand to lose out big time as the next credit crises is approaching soon.

About Andre Wouansi

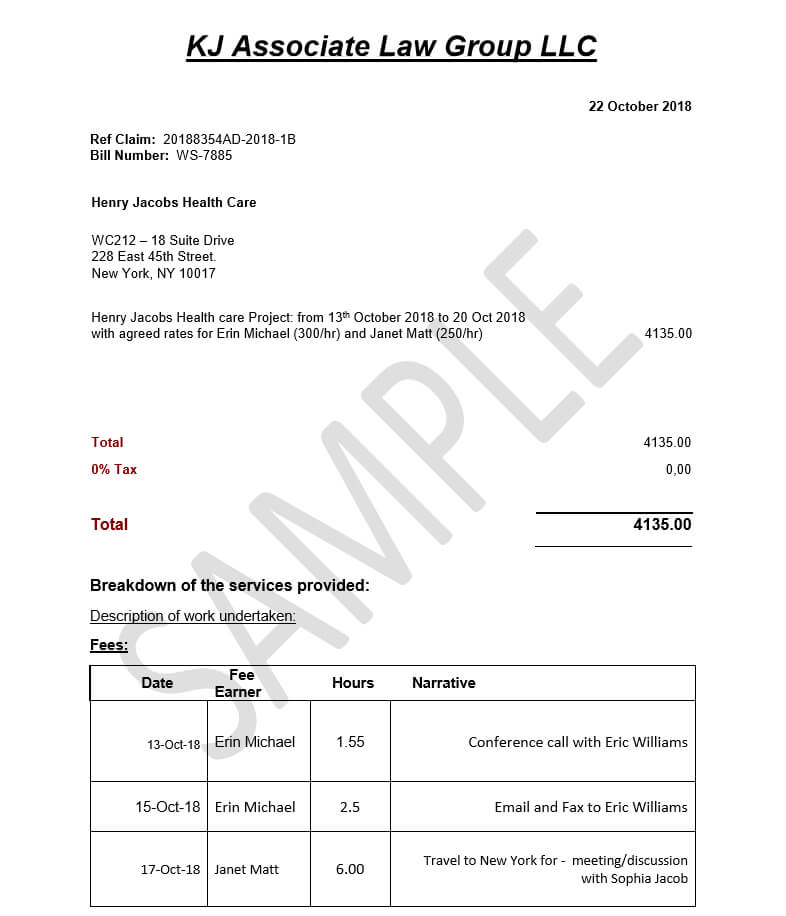

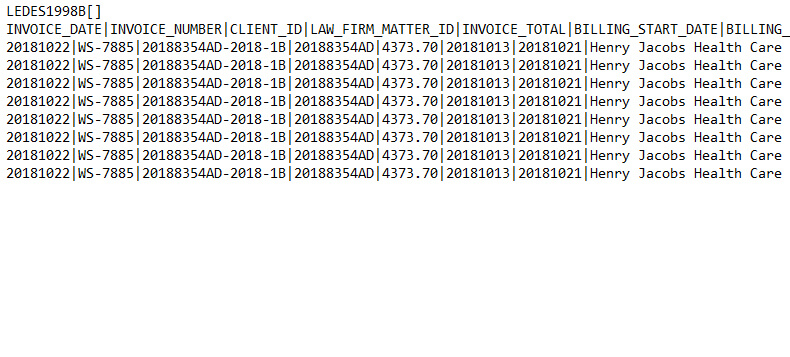

Andre Wouansi is the Founder and CEO at Accurate Legal Billing, Inc, the world’s first AI-enabled legal billing platform to ensure that law firms’ invoices are 100% compliant with clients’ billing guidelines.

Accurate Legal Billing (ALB) mission is “To help law firms across the world improve their cash flow and billing efficiency, by easily capturing their daily activities, preparing and submitting invoices that are 100% compliant with their clients’ billing guidelines.”

To schedule a demo, please visit: www.accuratelegalbilling.com/schedule-a-demo

.png)