HOW MONTHLY BILLING BONUSES ARE REDUCING YOUR FIRM’s PROFIT MARGIN:

A severely outdated and rudimentary practice still big in many law firms across the United States is the inclusion of monthly billing bonuses in the package of their senior associates and partners. However, these law firms do not realize that all this does is lead to worsening cash flow, given how the entire legal billing system is being revolutionized and e-billing is taking over the entire industry.

While these bonuses incentivize billing for increased billable hours, what the firms need to realize is that this leads to attorneys billing for activities and expenses with virtually no regard to their clients’ billing guidelines.

The necessity for advanced e-billing practices has become paramount since more and more insurance companies, Third Party Administrators and self-insured are availing the services of expert bill review vendors. The bill review vendors are motivated to ensure maximum reductions on every invoice examined by them which means that even the slightest non-compliance is penalized.

Equipped with state-of-the-art technology, bill review vendors find it very easy to detect the slightest non-compliances and make suitable reductions. Moreover, a recent study showed that the minimum reduction on invoices by bill review vendors is 6% on each invoice they receive. Additionally, for all their hard work, they charge 2% of the submitted invoice amount, which is, of course, deducted from the final amount of the law firm’s invoice. Hence, the average reduction faced by law firms for any given invoice is around 8%.

You are probably wondering what all of this has to do with the monthly billing bonuses being offered to your firm’s attorneys.

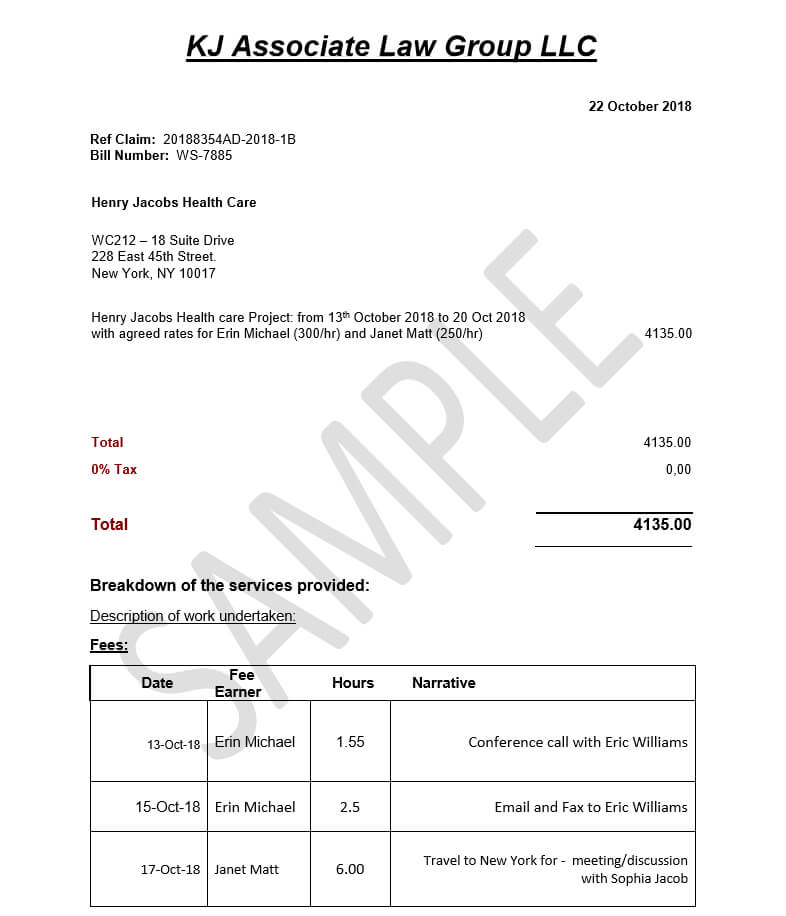

To understand this well, let us take the example of a law firm ABC which offers its Senior Associates and Partners a hefty monthly billing bonus as a part of their compensation packages. Meanwhile, let us assume they are using ‘XYZ’ time and billing platform, however, this platform does not ensure that the invoices prepared and submitted by the law firm’s billing department are entirely compliant with the firm client’s billing guidelines.

A partner at ABC generates 210 billable hours for the month at $350/hr. i.e. $73,500 potential revenue for the firm. Let us say he receives a monthly billing bonus of 5% of the invoice amount, which means his billing bonus for the month is $3,675.

When law firm ABC prepares and submits its invoice into the bill review vendor platform, the invoice is reviewed and reduced for various non-compliances citing reasons such as administrative tasks, paralegal tasks, travel time in violation of guidelines, block billing, etc and all of this amounts to $15,500.

Following several back and forths between the firm’s billing department and the bill review auditor, the invoice is finalized at $55,000.

Since the monthly bonus was calculated based on the initial invoice of $73,500 and bonus paid to the partner, the firm stands to lose $925, for that partner and for that month. For a law firm with 100 lawyers, this amounts to $92,500 per month or ~ $1,110,000 per year. In the long run, this will severely impact the firm’s cash flow and leave them with a decreased profit margin.

As you can see from this example, a lot of law firms are bleeding money through aggressive reductions by bill review vendors on firms’ invoices and as a result offering poor compensation packages offered to some of their staff.

One way to address this issue is to avail the services of a reputable time and billing company that has extensive experience in bill review and in maintaining compliance with various billing guidelines. A platform that automates the bill review process and ensures that the time entered by an individual attorney is always in 100% compliance with the client’s billing guidelines, thus leaving no room for error whatsoever such that once the invoice is generated, there will be minimal to zero reductions. This shall ultimately improve the cash flow and increase profit margin.

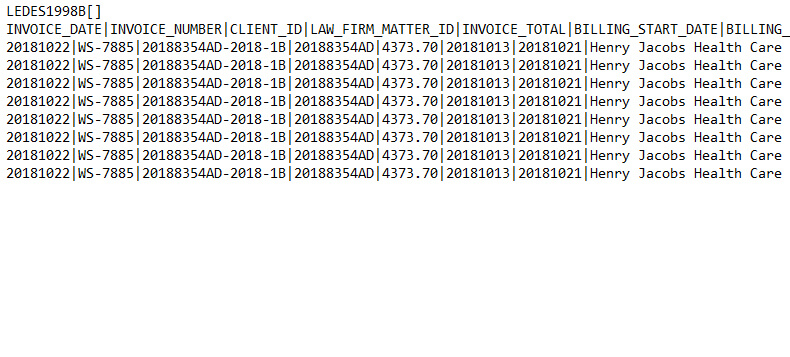

Accurate Legal Billing is an AI-enabled invoicing platform that ensures that every invoice prepared and submitted by a law firm is always 100% compliant with clients’ billing guidelines.

Andre Wouansi is the founder/CEO at ALB and prior to ALB he was one of the owners and group CFO at a US-based bill review company and that company reviewed millions of invoices worth over 5 billion dollars from law firms in over 50 countries.

.png)